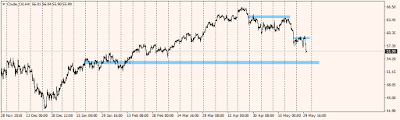

As, I mentioned previously that I’m bearish on Crude oil futures ( You can check my latest post here ). I’m still targeting the lows of the rally from confluence point of view & target was triggered after weekly supply around 64.00 hold the upside momentum & then we saw technical moves around 57.00 area when I pointed out few stop hunting moves & finally that level was given away by bulls yesterday after Crude oil futures data released & puts pressure on the WTI again.

Take a look that Chart below

In the post below, I’ve managed to spot out real time trade of usd/cad in which I’ve spotted a nice rally through supply & then retest of the small demand zone which triggered the entry & you can also take an entry around these levels at intraday highs with stop below yesterday low and see if we can make it count.

How to track best opportunity in Trading with minimal Risk

I have spotted out few very good and easy techniques to trade forex. Below is the chart of Usd/cad in which we see a nice Rally base rally through consolidation zone & flags that hold the price down . RBR through that zone & then one nice bullish strong candles through the top of the h4 supply.

After we witness a strong rally through the supply, yesterday price action moves in between that patriot candle telling us that price will find supply or demand again through the low of candle with no risk & atleast there was 10 time rewards with 8 pips stops & 80 points target around 1.3560 area.